Debunking the current 'myths'.

Reproduced with the kind permission of Yorkshire Bylines

The government and its supporters are beginning to claim the benefits of being outside the European Union and it would be churlish to suggest there are none. However, some of the benefits being claimed were either already available to EU member states or, in other cases, are not benefits at all. Yorkshire Bylines will attempt to record and where necessary debunk the claims using reliable and trustworthy sources.

This material and list are reproduced with the kind permission of Yorkshire Bylines.

The Reality

While travelling to the G7 summit in Japan in May, prime minister Rishi Sunak, pressed by reporters to offer a benefit of Brexit, said. “We reformed the alcohol duties that mean this summer you will be able to get cheaper beer in pubs. These are all very tangible benefits of Brexit that I’ve already delivered.”

The reality is that some beer may have had the amount of duty reduced but in the context of rising staff and other input costs, the average beer drinker is unlikely to notice any cheaper beer.

Simon Walkden, the Chief Operating Officer of the independent Thornbridge Brewery near Bakewell, said “costs of production have gone up around 25-30% in the past 18 months” and told The Drinks Business that the brewery was seeing inflated costs across “everything from energy to wages (national living wage uplifts) to malt, cans, bottles, packaging, transport – you name it.”

The production director at Adnans, a regional brewery in Suffolk echoed his comments. Fergus Fitzgerald pointed out that, “the only significant reduction in alcohol duty is on 3.4% ABV beer which could have been done whilst in the EU” and added: “Even here, it will have no impact at the bar as it’s dwarfed by all the other costs pubs and breweries have taken”.

Fitzgerald explained: “The duty on draught beer changing is, I believe, something that would not have been within the rules within the EU, but it is tiny, and actually the rate of draught beer hasn’t been reduced, it’s just stood still whilst everything else has gone up by inflation.”

He said that Sunak’s claims that, because of Brexit, “this summer you will be able to get cheaper beer in pubs” were based on “ignorance” or a “deliberate attempt to pretend” and stated: “Either it’s an amazing ignorance of what’s happened during the past year in hospitality, or a deliberate attempt to pretend that standing in the sea with an umbrella over your head means that your feet won’t get wet.”

Mr Walkden suggested that Sunak was simply “quoting the beer duty reforms” and so this was “cherry-picking just one of the component parts of the cost of producing and selling beer and that only applies to draught beer” and explained that “any discount in the draught rate just offsets the inflationary increase in the base duty rate of just over 10%”.

Conclusion: Sunak was being economical with the truth at best. Nobody will be getting cheaper beer in pubs this summer. While there has been a small change in the rate of duty paid on beer of 3.4% ABV(Alcohol by Volume) the savings are dwarfed by increases in everything else.

The Reality

The myth: In his March 2022 spring statement, Chancellor Rishi Sunak said:

“Thanks to Brexit, we are no longer constrained by EU law, so I can announce that for the next five years, homeowners having materials such as solar panels, heat pumps and insulation installed will no longer pay 5% VAT; they will pay zero.” (column 338 HERE)

The reality. It’s true that member states have to apply unified VAT rules that limit their discretion in setting VAT rates on individual goods and services. Member states must apply a standard VAT rate of 15% or more, and have the option of applying one or two reduced rates, usually no lower than 5% to certain specified supplies (as listed in Annex III to VAT directive 2006/112/EC).

Member states are also free to apply a reduced rate lower than the minimum of 5% and an exemption with the right to deduct input VAT, but only to a maximum of seven points listed in Annex III.

However, at the end of last year, the EU council approved a proposed directive to amend these rules governing reduced VAT rates at the ECOFIN meeting held on 7 December. The new rules grant EU member states more options and flexibility in determining the reduced VAT rates to apply to certain goods and services through amendments to Annex III of the EU VAT directive.

Among the changes is:

(10c) Supply and installation of solar panels on and adjacent to private dwellings, housing and public and other buildings used for activities in the public interest

The proposal said it was appropriate for solar panels to be included amongst the seven points “in line with Union environmental commitments on decarbonisation and with the Green Deal as well as to offer Member States the possibility to promote the use of renewable energy sources also by means of reduced VAT rates. To support the transition towards the use of renewable energy sources and to foster the Union’s self-sufficiency with regard to energy, it is necessary to allow Member States to improve final consumers’ access to green energy sources”.

The rules will be sent to the European parliament for consultation by March 2022. Once formally adopted, the legislation is effective on the 20th day following that of its publication in the Official Journal of the European Union.

Conclusion: The reduction in VAT on green energy sources makes sense but is not unique to the UK. The EU proposed a change before the UK and any differences are likely to simply be in the date the measures come into effect.

The Reality

The Daily Mail has published a story claiming that couples will soon be able to “combine sun-kissed cruises on British boats with tying the knot under new ‘Brexit dividend’ plans.”

The reality. The Law Commission is undertaking a consultation to reform UK laws on weddings to allow couples greater choice within a simple, fair and consistent legal structure. Their consultation on provisional proposals to reform the law governing how and where couples can get married closed on 4 January 2021 and responses are now being analysed. A final report with recommendations for Government is expected in July 2022.

The consultation paper says (page 313) that “Weddings at sea are, for most groups, not possible under the current law” and adds (page 338) that it is “a specific objective of this project to consider enabling weddings at sea.”

The Law Commission say “some couples from England and Wales choose to get married at sea and cruise companies already offer weddings in international waters, on board ships registered in countries where the law provides for weddings at sea: principally the Bahamas, Bermuda, and Malta.”

Since Malta is a member state of the EU, it appears there is no EU wide regulation which prevents marriages at sea in international waters aboard vessels registered in EU member states. Neither does the consultation paper mention any EU regulations or directives which prevented UK authorities reforming marriage laws at any time prior to 1 January 2021 when Britain left the bloc.

In fact the website Hitched confirms this is already perfectly possible. In their “ultimate guide” to exchanging vows on board a cruise ship, they say cruise companies like Princess, P&O, Celebrity, Royal Caribbean and Cunard all “plan thousands of weddings on board each year.”

The cruise company Princess have an entire section of their website dedicated to at sea or harbourside weddings.

So, while weddings aboard UK registered vessels are definitely illegal at present under British law it is not clear why the Daily Mail believes Brexit has somehow enabled reforms, which any UK government could have implemented since the main law on marriage in this country was passed in 1836.

The Myth

No 11: Leaving the EU has allowed the UK to put the old crown stamp back on to pint glasses

The Reality

Boris Johnson has named returning the crown stamps to pint glasses as one of the “key successes” of Brexit this year.

The reality. This concerns the crown symbol which used to be printed on pint glasses as a guarantee to the consumer that it would hold a pint. It was replaced in 2006 by a European Union-wide ‘CE’ mark instead.

Firstly, some background. Under the Measuring Instrument Directive (2004/22/EC) a glass is a “capacity serving measure”, designed to “determine a specified volume of a liquid (other than a pharmaceutical product) which is sold for immediate consumption”.

It came into force in October 2006. Glasses that conform to the directive must carry the CE mark (Article 7).

But 7.3 also says [our emphasis]:

“The affixing of markings on a measuring instrument that are likely to deceive third parties as to the meaning and/or form of the ‘CE’ marking and the supplementary metrology marking shall be prohibited. Any other marking may be affixed on a measuring instrument, provided that the visibility and legibility of the ‘CE’ marking and the supplementary metrology marking is not thereby reduced.”

So, any other marking, such as a crown, is permitted as long as it isn’t likely to deceive and doesn’t obscure the CE mark.

But guidance issued by the UK government in July 2015 declared the crown stamp would be illegal under article 7.3 because it was “considered likely to deceive third parties” although how or why isn’t made clear. The UK government guidance said:

“National markings such as the prescribed stamp that are intended to indicate the reliability of the marking are not permitted by Article 7.3 of the Directive and may not be used alongside the CE marking.”

Nonetheless, the guidance does add that “Stylised crown markings on beer glasses etc are permitted on a voluntary basis as a decoration provided that they are marked in such a way that they could not be confused with the CE marking”.

Further, in an article from 2007 EU Vice-President Gunter Verheugen is quoted saying the same thing, that although national markings are not allowed next to the CE marking, if the crown stamp was now considered as voluntary and meaning something else, “a Crown stamp look-alike could naturally be affixed to the glass, as long as it is done in such a way that it is not confused with the CE marking”.

A Tory MEP, John Bowis said at the time: “This always appeared to be a case of over-interpretation of a Directive by the UK authorities. I do not believe the Crown marking would deceive the public about the meaning or form of the CE marking. On the contrary, it would reinforce consumer confidence.”

Conservative MEP Malcolm Harbour, internal market spokesperson, added: “This is another example of British civil servants interpreting EU law in an excessively pernickety way. We always considered that a dual marking would not confuse consumers and are pleased that the Commission has confirmed our view.”

In September this year the Daily Express confirmed the crown stamp will be added on a “voluntary” basis.

Conclusion: It appears we could have had crown symbols on pint glasses all along, provided they didn’t purport to indicate the reliability of the measure.

The Reality

It has been widely claimed that only burgundy passports were permitted by Brussels. This article from The Sun in August 2016 has Tory MP Andrew Bridgen backing a campaign to “reintroduce the true blue, ditched in 1988 for an EU-approved burgundy passport.”

The reality. There has been any number of articles debunking this myth but this one in The Journal, an Irish news outlet which is a signatory to the International Fact-Checking Network’s Code of Principles, is helpful and trustworthy.

A 1981 resolution dealing with passport uniformity said the passport should be “burgundy red” in colour but it was not legally binding. Further resolutions in 2004 made no reference to the colour of the front cover.

Not all member state passports have burgundy covers. Most EU passports are shades of red, but the passport for Croatia, which joined the EU in 2013, is dark blue. In August 2015, Ranko Ostojic, the Croatian interior minister, told the Večernji List newspaper that the EU’s position is that there is no obligation to change the colour of the passport.

“Not all European passports are burgundy red, they range from brown to burgundy to dark red. We are not going to change our colour, just add the European Union title” Mr Ostojic said.

A 2017 book ‘What has the EU Ever Done for Us? How the European Union Changed Britain’, by David Charter quotes an EU spokesperson, who confirmed resolutions are non-binding and “there are still some differences between the various models of passports issued by the member states”.

The spokesperson said the 2004 regulations achieved harmonisation on security features and biometrics, “However format and layout as well as issuing procedures remain within the competence of the Member States,” they said.

Conclusion: There was never any legally binding EU rule that forced the UK to have burgundy-coloured passports.

The Myth

No 9: Excluding lawnmowers and buggies from compulsory insurance was only possible outside the EU

The Reality

Transport secretary Grant Shapps has implied that only by leaving the EU can Britain avoid compulsory insurance for vehicles on private land.

The reality. This concerns the EU’s so-called ‘Vnuk’ law (named after a Slovenian worker who fell from a ladder after it was struck by a tractor and the ECJ ruling which followed) which requires motor insurance on private land for a wider range of ‘vehicles’, including buggies, ride-on lawnmowers and mobility scooters. The government claims that scrapping it saves an estimated £2bn in insurance premiums, worth about £50 for each British driver.

The £2bn figure comes from the government actuary’s department (GAD) which, in the impact analysis, admits they “have not been able to obtain any data to help quantify the extent to which cars are used on private land” but they make two big “assumptions.”

- Because driving on private land would be insured, this activity and therefore the number of accidents will rise

- Increased claim frequency will lead to an increase in fraud

The former will require higher premiums and the latter a higher levy by the Motor Insurers’ Bureau, which is responsible for compensation claims arising from accidents caused by uninsured or untraceable motorists.

However, the figure seems excessive given the total for all motor insurance claims in the UK in 2018 was only £7bn. The government appears to think nearly 30 percent of claims in future will be on private land, admitting that this does not include car parks, which are considered to be areas where the public has access.

Next, the impact analysis admits the EU Commission has already issued an inception impact assessment on the Vnuk case and has “proposed high level amendments to the Motor Insurance Directive which would clarify that use of vehicles on private land would not be within the scope of the Directive” (HERE paragraph 2.7).

So, the EU has already recognised the cost implications of the Vnuk ruling and plans to amend the EU-wide motor insurance directive in any case, so Brexit had little if any impact.

Conclusion: It appears the potential ‘savings’ may be unrealistically high and there is no advantage for UK drivers since European motorists will also be able to avoid taking out compulsory insurance for a wider range of vehicles used on private land.

The Myth

No 7: The Daily Express is reporting claims by Health Secretary Matt Hancock that the UK was able to approve a drug for treating lung cancer quicker because we have left the EU.

The Reality

The report concerns the drug Osimertinib, made by AstraZeneca and sold under the brand name Tagrisso. It was licensed by the European Medicines Agency (EMA) previously, but it has been extended to include use in early-stage disease treatment after the cancer has been surgically removed.

The Express report adds that the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) will make the final decision. But the EMA website suggests the same change is also being made to the EU approval.

On 22 April 2021, the EMA said, the “Committee for Medicinal Products for Human Use (CHMP) adopted a positive opinion recommending a change to the terms of the marketing authorisation for the medicinal product Tagrisso. The marketing authorisation holder for this medicinal product is AstraZeneca AB”.

Approval for this change to the marketing authorisation is now awaiting a decision by the European Commission.

As far as Yorkshire Bylines can determine, if there is any difference between the date when Tagrisso is approved for early-stage cancer treatment in the UK and in the EU, it is not likely to be significant.

The Myth

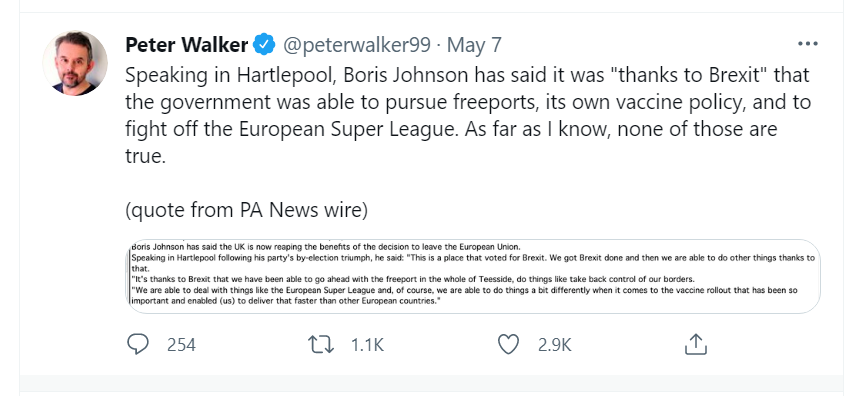

No 6: The Prime minister has claimed that Brexit enabled the UK to block plans for a European Super League in soccer.

The Reality

The claim appears to be without foundation. It was the withdrawal of UK clubs under huge public pressure, and English clubs were HALF of the proposed Super League anyway, that brought about an end to the plans.

There is evidence to suggest that the prime minister initially supported the Super League idea during a meeting with Manchester United executive vice chairman, Ed Woodward on 14 April. The Sunday Times reported that just four days before its launch, the Prime Minister may have given Mr Woodward the impression he would back the proposal.

It is perhaps another case of Johnson Boris waiting to “see which way the crowd is running before jumping to the front and yelling ‘follow me” as Lord Heseltine once suggested.

The Reality

The Health Secretary Matt Hancock and Leader of the House Jacob Rees-Mogg have claimed that Brexit allowed the UK to authorise the use of the Pfizer vaccine before countries in the EU.

This is not true. The BBC fact checked it and said, “the fact that the UK is the first country in the world to approve this vaccine has got nothing directly to do with Brexit.”

The chief executive of the UK’s Medicines & Healthcare products Regulatory Agency (MHRA), Dr June Raine, has said that "we have been able to authorise the supply of this vaccine using provisions under European law, which exist until 1 January".

The BBC quoted Dr Raine saying, "Our speed or our progress has been totally dependent on the availability of data in our rolling review, and the rigorous assessment and independent advice we have received."

Even before approval the MHRA website said:

“However, if a suitable COVID-19 vaccine candidate, with strong supporting evidence of safety, quality and effectiveness from clinical trials becomes available before the end of the transition period, EU legislation allows for temporary authorisation of supply in the UK, based on the public health need.”

The MHRA gave temporary authorisation to the supply of specific batches of Pfizer-BioNTech's vaccine on 2 December 2020. EU member states could have used the same provisions but chose not to.

The Reality

There is no new ‘globally unique opportunity’, since Norther Ireland had access to both the UK and the EU27 through the single market before Brexit. The extra border formalities between NI and GB are a disadvantage.

Aodhán Connolly, director of the Northern Ireland Retail Consortium writing on the UK in a Changing Europe website on the very last day of 2020, says:

“There is a plethora of red tape for business in Northern Ireland and, notably, those in GB who trade with NI. And remember, the supply chain will always take the path of least resistance. It doesn’t matter if the new costs are 1% or 1000% above the profit margin, it means those businesses won’t deal with Northern Ireland.”

Mr Connolly says they will look to see at how there can be further simplifications on processes such as customs formalities or SPS requirements which “must provide a long term, practicable and workable solution to allow NI business to be competitive and keep costs down for NI households”.

Secretary of State Brandon Lewis has actually denied the Irish Sea Border is a border at all but seems to portray the additional paperwork burden associated with customs, Sanitary and Phytosanitary (SPS) checks as a ‘benefit’.

The BBC’s Northern Ireland editor John Cambell describes the new arrangements as a “trade border” and described trucks being stopped at “border control posts” for lack of correct paperwork.

The Reality

The government plans up to ten freeports across the UK, with the implication that this is only possible because the UK has left the EU. A report in City AM from October says, “The initiative will be made possible when the country leaves the EU’s single market and customs union on 31 December”. This is not true. The BBC reality checker from July 2019 makes it clear that there are more than 80 free ports already in the EU.

The BBC reality check links to a 2018 report from the House of Commons Library which explains that, until 2012 when establishing legislation was allowed to expire, there were free port areas already in Liverpool, Southampton, Tilbury, Sheerness and at Prestwick Airport and that “the Treasury currently has the power to designate free ports by Statutory Instrument”. So being a member of the EU did not prevent us having freeports.

The respected UK Trade Policy Observatory (UKTPO) cautions that evidence of wider economic benefits of freeports and other zones is “mixed” and there is “also a risk that freeports and zones don’t create new economic activity but rather divert existing business into the area with the allure of tax breaks – at a cost to the taxpayer in the form of lost revenue”.

The Reality

In 2016 the UK won a promise from the EU to be able to scrap the current 5 percent VAT on sanitary products, with the government believing the new system would be in place by April 2017.

After the referendum, the timetable slipped. There is “no sign that the current Tory government has pushed the issue in Brexit talks”, Labour MP Paula Sherriff said in 2018.

But the European Commission still published proposals covering the abolition of the tampon tax in 2018. Although the earliest date for implementation is January 2022, that’s just one year after the transition period ended.

So we could have abolished the tampon tax ourselves at least three years ago, or we could have waited another year and the EU would have abolished it across all remaining member states.

The Reality

France’s agriculture ministry announced in August 2019 that it had officially banned electric pulse fishing from its territorial waters, ahead of a total ban of the contested practice in the European Union set for 2021.

Bernard Jenkin MP claims that although the EU did ban it, the practice is not totally outlawed since it is still permitted under the guise of research. Some campaigners believe pulse fishing is less stressful for fish.

It is not clear how much pulse fishing was actually carried out in UK waters anyway.